Founded in 1976, Bankrate has a protracted reputation of aiding folks make good economical decisions. We’ve taken care of this popularity for over four many years by demystifying the financial decision-producing procedure and offering persons confidence through which actions to just take following. Bankrate follows a rigid editorial policy, so that you can believe in that we’re Placing your passions first.

Apply on the web: Whilst you can apply for a private loan in individual or more than the cellphone with a few lenders, on the internet loans typically provide the quickest approval times.

Pre-qualify and Evaluate lenders to locate the finest APR, which largely is determined by elements like credit score score and income. Pre-qualification only needs a comfortable credit score Verify, so you're able to price store without having impacting your rating.

Property equity loans Home equity loans Permit you to borrow a lump sum at a set price, based on how much of the home you individual outright.

Effect on your credit history may perhaps differ, as credit rating scores are independently determined by credit history bureaus based upon a variety of variables such as the financial selections you make with other economical companies organizations.

How do speedy private loans have an impact on my credit rating? Chevron icon It implies an expandable part or menu, or sometimes previous / next navigation options.

Jordan Tarver has used 7 many years masking property finance loan, personalized loan and business loan written content for leading money publications such as Forbes Advisor. He blends awareness from his bachelor's diploma in organization finance, his working experience being a top perf...

Upstart is a great selection for swift funding If the credit score rating is among 600 and 660. Having said that, the lender involves other pieces of knowledge in its acceptance selections — which include where you went to highschool and also your location of research — which makes it very good for borrowers who might not qualify for your loan exclusively based mostly on their own credit rating on your own.

Financial institutions or credit rating unions usually offer you the bottom annual percentage charges (APRs), which characterize the whole price of borrowing, for private loans. Loan amounts vary from a number of hundred dollars to $fifty,000 or even more, and repayment phrases normally range from two to 7 several years.

The ideal own loans for swift accessibility give an easy application course of action and minimal expenses. Conveniently, there are lots of sturdy options for identical-day loans or subsequent-working day funding.

Even though it could get various business times for the money to arrive in your account, some lenders offer exact- or upcoming-day funding speeds. Nevertheless, this convenience could include higher desire prices and costs, so it is best to Assess more info the most beneficial quick-cash loans right before making use of.

"Repayment conditions may be very important in determining the overall Value of your loan. Considered one of the biggest things to Be careful for are origination fees. Origination charges are taken away from the whole proceeds of one's loan and decrease the overall sum of money you receive."

But this payment doesn't influence the data we publish, or the evaluations that you just see on This website. We don't consist of the universe of providers or economic features Which might be available to you.

Jordan Tarver has used seven yrs covering mortgage loan, private loan and company loan written content for top financial publications such as Forbes Advisor. He blends understanding from his bachelor's diploma in enterprise finance, his knowledge like a top rated perf...

Edward Furlong Then & Now!

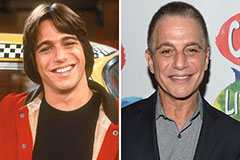

Edward Furlong Then & Now! Tony Danza Then & Now!

Tony Danza Then & Now! Jonathan Lipnicki Then & Now!

Jonathan Lipnicki Then & Now! Marques Houston Then & Now!

Marques Houston Then & Now! Nancy McKeon Then & Now!

Nancy McKeon Then & Now!